PGBP

PGBP Income means profits and gains of business or profession, Hence it includes profits and loss of:

- Any Business

- Any Profession

As per section 28, income from any business/profession shall be taxable under the head Business/Profession.

The following incomes shall also be taxable under the head Business/Profession.

(i) Income from Speculation Business shall be taxable under the head business/profession.

(ii) Gift in connection with business/profession.

(iii) Payments for not pursuing any business activity or profession/non-compete fee.

iv) Payment under Keyman Insurance Policy.

(v) Export Incentives.

Meaning of Business:

Business includes trade, commerce, manufacture, any adventure/concern in the nature of trade/commerce, etc.

Meaning of Profession:

There is no proper definition of Profession is given under Income Tax Act.

According to sec. 2(36) of Income Tax Act, “profession” includes vocation.

Sec. 44AA deals with the professions that required to maintain books of accounts are,

- Legal

- Medical

- Architectural

- Accountancy

- Technical consultancy

- Interior decoration

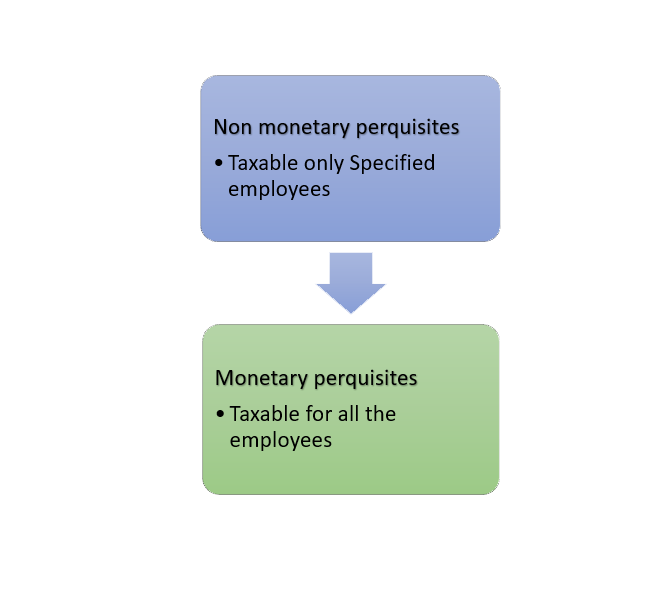

PERQUISITES

Perquisite means facilities or perks given by employer and are as given below:

PERQUISITIES TAXABLE FOR ALL TYPES OF EMPLOYEE

- Rent Free Accommodation

- Accommodation at concessional rent

- Motor Car facility

- Gardener/Watchmen/Sweeper or any other servant

- Gas/Electricity/Water

- Education Facility

- Transport facility

- Payment by the employer on behalf of the employee

- Any contribution to an approved superannuation fund by the employer in respect of an employee

- Any other fringe benefit

- Loan to the employee either at concessional rate or free of interest

- Expenditure in connection with travelling, touring or accommodation to the employee

- Free refreshment or foods to the employees

- Any gift, voucher or token

- cards Expenses on credit

- Club Membership and expenses incurred in a club

- Use of moveable assets

- Transfer of any moveable asset

- Any other benefit

- Medical Facility

- Leave travel Concession Sec.

Specified Employees

The following person shall be considered as specified employees: –

- An employee who is a director of company.

- An employee being a person who has substantial interest in the company i.e. who is the beneficial owner of equity shares carrying 20% or more of the voting rights in the company

- Any other employee whose income chargeable under the head “Salaries” exceeds Rs 50,000.

While calculating limit of Rs 50,000 following amount shall be excluded: –

- All non monetary benefits

- All monetary payments exempt under Section 10

- Deduction under section 16

PRESUMPTIVE BUSINESS INCOME

To reduce the tax burden and provide relief from tedious work to small taxpayers, the Government of India has introduced a presumptive tax scheme. Businesses that adopt the presumptive tax scheme are not required to maintain regular accounting books. They can declare income at a prescribed rate.

Eligibility Criteria to avail the Benefits of Presumptive Taxation Scheme under Section 44AD

Below are the types of tax assesses who can adopt the provisions of presumptive taxation scheme Under Section 44AD:

- Resident Individual tax payers

- Hindu Undivided Families

- Partnership Firm (except LLP or Limited Liability Partnership Firm)

Eligible Business: – All Small Business where turnover less than or equal to 2 crore p.a.

Presumptive rate of Income: – 8% of Turnover or Gross receipts, however 6% shall be deemed as income. If total Turnover is received by an account payee cheque/ draft/ by use of electronic mode through a bank.

Eligibility Criteria to avail the Benefits of Presumptive Taxation Scheme under Section 44ADA

The Income of any person making use of this Section would be assumed to be 50% of the Total Gross Receipts for the year.

This scheme is applicable only

- to a resident assessee who is an Individual,

- HUF or Partnership but not a Limited Liability Partnership firm.

The following are considered as professionals who can make use of this Section:-

- Legal

- Medical

- Engineering

- Architectural Profession

- Profession of Accountancy

- Technical Consultancy

- Interior Decoration

The assessee would also NOT be required to:-

- Maintain books of accounts under sub-section (1) of Section 44AA, or

- Get the accounts audited under Section 44AB in respect of such income.

TAXABILITY OF ALLOWANCE & PERQUISITIES

What is Allowances?

Any monetary benefit offered by the employer to its employees to cover expenses, in addition to the basic salary, is known as wage allowances.

Employers offer various types of additional benefits in monetary terms to their employees in addition to the basic salary, which are known as wage allowances. These salary subsidies are granted to cover expenses of a particular nature.

Various types of allowances are discussed below:

Fully Taxable

- Entertainment Allowance

- Dearness Allowance

- Overtime Allowance

- Fixed Medical Allowance

- Servant Allowance

- Project Allowance

- Any other cash Allowance

Partly Taxable

- House Rent Allowance u/s 10(13A)

- Special Allowance u/s 10(14)