Income From

Salary

Salary income is the income or remuneration that a person receives for the services he renders or a contract entered into by him.

This amount of remuneration will be considered as income for the purposes of the Income Tax Law only if there is an Employer and employee relationship between the person making the payment and the person receiving the payment

Meaning of Salary

The salary for the purpose of calculation of income from salary includes:

- Wages

- Pension

- Annuity

- Gratuity

- Advance Salary paid

- Fees, Commission, Perquisites, Profits in lieu of or in addition to Salary or Wages

- Annual accretion to the balance of Recognized Provident Fund

- Leave Encashment

- Transferred balance in Recognized Provident Fund

- Contribution by Central Govt. or any other employer to Employees Pension A/c as referred in Sec. 80CCD.

Calculation of Income from salary

| Particulars | Amount |

|---|---|

| Basic Salary | – |

| Add | – |

| 1.Fee Commission and Bonus | – |

| 2.Allowance | – |

| 3.Perquisites | – |

| 4.Retirement Benefits | – |

| Gross Salary | – |

| Less: Deduction From Salary | – |

| 1.Standard Deduction | – |

| 2.Entertainment allowance | – |

| 3.Professional Tax | – |

| Net Salary | – |

TAXABILITY OF PROVIDENT FUND

Under this scheme, a specific sum is deducted from the employee’s salary as his contribution to the fund. The employer also usually contributes the same amount out of pocket to the fund. Employer and employee contributions are invested in approved securities. Accrued interest is also credited to the employee’s account.

Therefore, the credit limit in an employee’s provident fund account consists of the following:

(i) employee contribution

(ii) interest on the employee’s contribution

(iii) employer contribution

(iv) interest on employer contribution

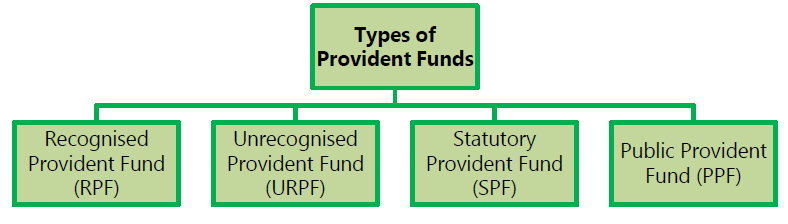

- Recognized provident fund (RPF): A recognized Employee Provident Fund is a plan approved by an income tax commissioner. Applies to organizations or factories with 20 or more employees.

- Unrecognized Provident Fund (URPF): A fund not recognized by the Income Tax Commissioner is Unrecognized Provident Fund.

- Statutory Provident Fund (SPF): The SPF is governed by the Provident Fund Act of 1925. It applies to employees of the government, railways, semi-government institutions, local agencies, universities and all recognized educational institutions.

- Public Provident Fund (PPF): The Public Provident Fund is managed under the Public Provident Fund Act of 1968. Membership of the fund is open to everyone, although it is ideal for self-employed workers. A salaried employee can also contribute to PPF in addition to the fund operated by his employer.

The payments received by an assessee from the following funds at the time of retirement or otherwise, would be fully exempt from tax.

TAXABILITY OF RETIREMENT

On retirement, an employee normally receives certain retirement benefits. Such benefits are taxed under the heading “Salaries” as “Profits in lieu of Salaries”, as provided in section 17 (3). However, with respect to some of them, tax exemption is granted u / s 10 of the Income Tax Act, either totally or partially.

These exemptions are described below:-

- Gratuity:

Gratuity means a gratuitous payment made by the employer to the employee at the time of his leaving the job in recognition of the meritorious services and the association of the employee with the institution.

Any death-cum-retirement gratuity is exempt from tax to the extent of least of the following:

- 2000000

- Gratuity actually received

- 15 days salary based on last drawn salary for each completed year of service or part thereof in excess of 6 months

Note: Salary for this purpose means basic salary and dearness allowance. No. of days in a month for this purpose, shall be taken as 26.

- Not covered by the Payment of Gratuity Act, 1972

Any death cum retirement gratuity received by an employee on his retirement or his becoming incapacitated prior to such retirement or on his termination or any gratuity received by his widow, children or dependants on his death is exempt from tax to the extent of least of the following:

- 20,00,000

- Gratuity actually received

- Half month’s salary (based on last 10 months’ average salary immediately preceding the month of retirement or death) for each completed year of service (fraction to be ignored).

- PENSION:

Taxability of Pension

Uncommuted pension

Pension is a periodical payment received by an employee after his retirement and is taxable as salary in case of all categories of employees.

Commuted pension Section 10(10A)

- Commuted Pension received by employees of Central Government, State Government, Local Authority or Statutory Corporation.

It is wholly exempt from tax under section 10(10A).

- Commuted pension received by any other employee

(a) In case where any other employee receives gratuity, the commuted value of 1/3rd of the pension is exempt from tax.

(b) If the employee has not received gratuity, the commuted value of ½ of such pension is exempt from tax.

Generally, employees are allowed to take leave during the period of service. Employee may avail such leave or in case the leave is not availed, then the leave may either lapse or be accumulated for future or allowed to be encashed every year or at the time termination/ retirement. The payment received on account of encashment of unavailed leave would form part of salary. However, section 10(10AA) provides exemption in respect of amount received by way of encashment of unutilised earned leave by an employee at the time of his retirement, whether on superannuation or otherwise.